Introduction

In this blog post, I am going to show you How To File KRA Nil Returns On iTax online today quickly and easily with a full illustration of the steps.

Do you have an active KRA PIN and you don’t have a source of income (unemployed)? Check out our article on How To File KRA Nil Returns using iTax Portal quickly and easily today. Filing of KRA Nil Returns is allowed for taxpayers who do not have any source of income. When I talk of a source of income, it means that the taxpayer does not have Business Income, Rental Income, or Employment Income, thus the need to file KRA Nil Returns on the iTax Portal.

In this article, I am going to share with you the step-by-step guide that you need to follow in order to file your KRA Nil Returns using KRA iTax Portal. By the end of this article, you will have learned How To File KRA Nil Returns if you have a KRA PIN and are not in employment. Avoid the last-minute rush and penalties by filing your Nil KRA Returns before the 30th June 2022 deadline.

Do you have an active KRA PIN and you don’t have a source of income (unemployed)? Check out our article on How To File KRA Nil Returns using iTax Portal quickly and easily today. Filing of KRA Nil Returns is allowed for taxpayers who do not have any source of income. When I talk of a source of income, it means that the taxpayer does not have Business Income, Rental Income, or Employment Income, thus the need to file KRA Nil Returns on the iTax Portal.

In this article, I am going to share with you the step-by-step guide that you need to follow in order to file your KRA Nil Returns using KRA iTax Portal. By the end of this article, you will have learned How To File KRA Nil Returns if you have a KRA PIN and are not in employment. Avoid the last-minute rush and penalties by filing your Nil KRA Returns before the 30th June 2022 deadline.

Requirements

- KRA pin number

- Itax portal password

If you don't remember the password, you can always reset it using the email registered under the KRA Pin number.

To know which email is registered under your PIN, you can check in your KRA PIN certificate its indicated there or you can go to the report problem section and paste or type in your KRA PIN number and your email will be shown. For more assistance, you can WhatsApp us.

Steps

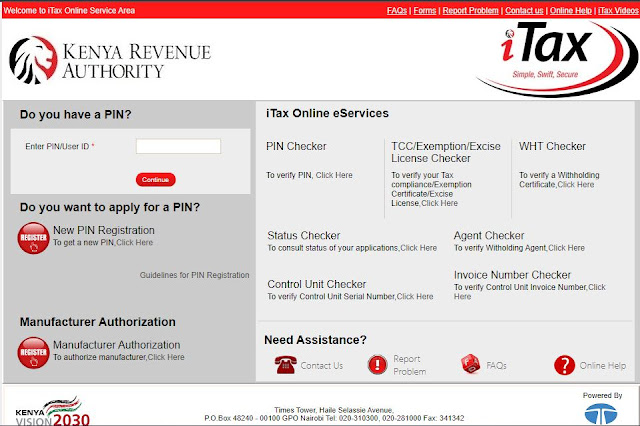

- Step 1: login to itax portal

- Step 2: Enter your KRA pin number then click on "Continue"

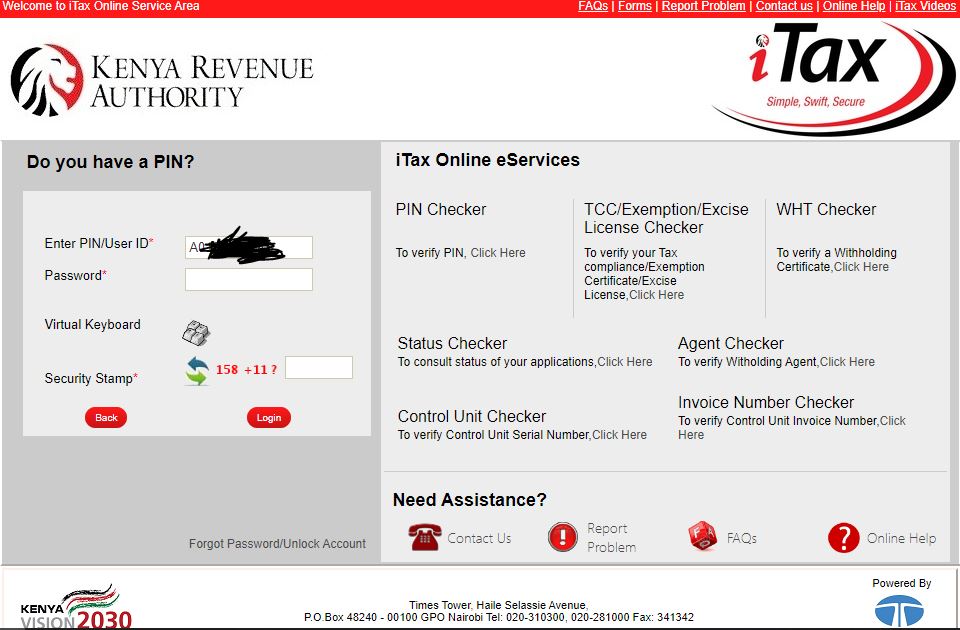

- Step 3:Type in your password or reset/unlock if you have forgotten.

- Step 4: Calculate the simple math security stamp and click login

- Step 5: Once you log in, head over to the returns section, hover your mouse cursor on it, then select "file nil return."

- Step 6: Select your tax obligation as indicated in the KRA pin certificate, usually its Resident Individual.

- Step 7: The return period will be automatically added for the previous year or the current return period (the previous year i.e., the return period in 2022 is 01/01/2021 to 31/12/2021). If not automatically added it means: -

- You have pending returns for another return period like 2020 or 2019 and so on.

- You registered for your certificate the previous year after 01/01/2021 so file starting from the day you registered for KRA to the end of that year e.g., 10/05/2021 to 31/12/2021. Kindly note I'm only using 2021 as an example since we are in 2022, next year (2023) we will do returns for the previous year (2022).

You can reach out to us on WhatsApp for

- assistance

- filing

- new pin registration

- forgot password

- change email

- amend pin details

- etc

Comments

Post a Comment